We are immensely happy about the great interest in becoming a member of our Founders’ Club. Several aspiring members with limited knowledge of the market for single malts from startup distilleries, however, have asked why the price of the membership is 200€. It’s a fair question, considering the average cost of a bottle of gin + a bottle of whisky (which is part of your reward package as a member).

Of course, we believe your membership subscription is partly your way of supporting us. But we also want you to feel that it is good value for money.

The membership entitles you to lifelong discounts for events, products etc. plus discount on your potential purchase of shares in the company. But if we ignore that for a moment, the market price for quality single malts from acknowledged startup craft distilleries is extremely high. The simple reason is that demand is so incredibly much higher than the supply. Quality craft distilleries are few with low production output, and the global number of us single malt lovers is very high. Also, 1. editions tend to become collectors items or investment objects that are stored or traded rather than consumed.

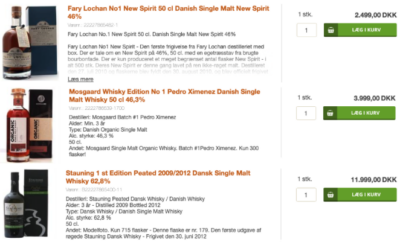

To illustrate, here are a few examples of the cost of 1. editions from distilleries that have been created within the last 15 years. I have chosen some examples from Denmark, as I think the proximity may be a relevant factor.

1 DKK = 0.13€

The Global Whisky Market

All available data indicate that the supply of malt whisky is not keeping pace with growing demand.

Despite the growing number of distilleries (over 100 new distilleries in the last five year alone) and the plans of many existing distilleries to increase production, it seems that this trend is not endangered in the long run.

This is the reason why we see established distilleries putting so many NAS (No Age Statement) bottles on the market. They simply do not have enough aged whisky in their stock to meet the demand.

In 2019, Scotch whisky export reached record levels both in volume and value. The Scotch Whisky Association, citing the HM Revenue & Customs data, announced that Scotch whisky export reached £4.91 billion last year, which was an increase of 4.4% compared to 2018.

If you want to see whisky as an investment, it is one the most profitable investment objects of alternative assets. For many years, rates of return on investment in whisky have been very high, beating other alternative investments, such as rare coins, wine, art and watches.

The uniqueness of investments in whisky is that it is independent of financial markets, so even an economic crisis does not affect them. Premium and super-premium spirits are virtually recession-proof. It seems that in hard times, people drink less but better. Between 2008, the year the financial crisis began, and 2015, Britain’s overall consumption of whisky declined 19.6%. But sales of the much more expensive single malt whisky went up 5.5%.

It seems, a recession is a good time to start a business dealing in top-of-the-range spirits such as malt whiskies and premium gins.

A few resources to read more

The Craft Distillers’ Handbook – by Ted Bruning, Lovely Moon Publishing, 2. ed 2017

The Science and Commerce of Whisky – by Buxton & Hughes, Royal Society of Chemistry, 2014

Whisky: Technology, Production and Marketing – by Inge Russel, Academic Press, 2015

Stillnovisti Whisky Investment